What Is an SBA Loan?

The Small Business Administration (SBA) loan program is a government-backed initiative designed to support small businesses by providing financial assistance. SBA loans are not directly disbursed by the government; instead, they are issued by approved lenders, such as banks and credit unions, with partial guarantees from the SBA. These loans are particularly appealing due to their lower interest rates and flexible repayment terms compared to conventional loans.

Types of SBA Loans

- 7(a) Loans: Ideal for general business needs such as working capital, equipment purchase, or debt refinancing.

- CDC/504 Loans: Specifically for major fixed assets like real estate or large equipment.

- Microloans: Smaller loans for startups and businesses needing minimal funding.

Understanding the type of loan that fits your needs is crucial to streamline the application process.

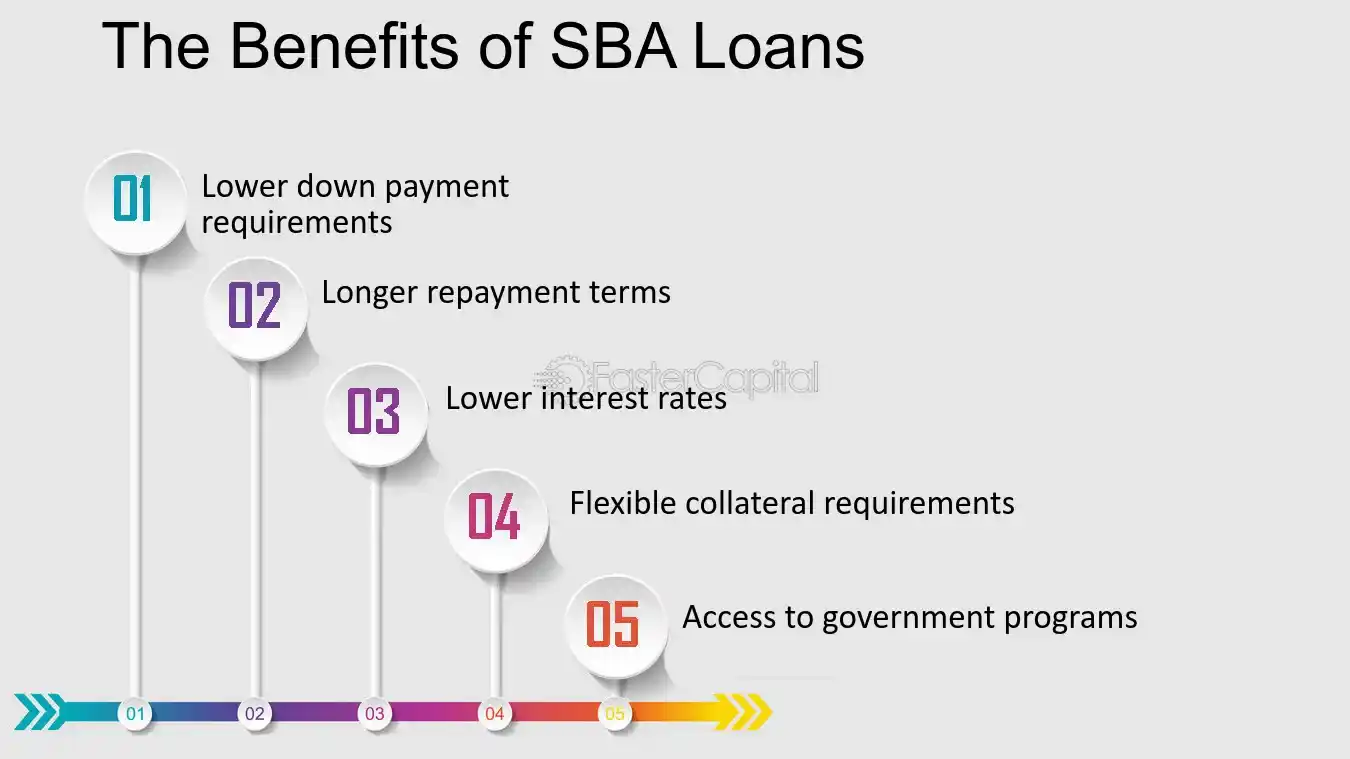

Benefits of SBA Loans

- Lower Interest Rates: SBA loans typically have more favorable rates compared to standard business loans.

- Longer Repayment Terms: These can extend up to 25 years for real estate and 10 years for working capital.

- Support for Startups and Small Businesses: SBA loans are tailored to businesses that might struggle to secure traditional financing.

- Access to Larger Loan Amounts: With SBA backing, lenders are more likely to offer substantial loan amounts, which can support significant business growth.

- Guidance and Support: Many SBA loans come with added benefits, such as access to mentoring, business counseling, and educational resources.

- Improved Loan Approval Odds: The SBA guarantee reduces the risk for lenders, making it easier for businesses with less conventional credit profiles to obtain financing.

- Flexible Use of Funds: Depending on the loan type, funds can be used for various purposes, including working capital, expansion, equipment purchase, or refinancing debt.

Eligibility Criteria for SBA Loans

To qualify for an SBA loan, your business must meet specific criteria:

- Size Requirements: Your business must be classified as “small” based on SBA standards.

- Creditworthiness: A solid personal and business credit history is often necessary.

- Operational Criteria: Businesses must operate within the U.S., demonstrate a need for financing, and use the loan for approved purposes.

Specific SBA loan programs may have additional requirements, so thorough research is recommended.

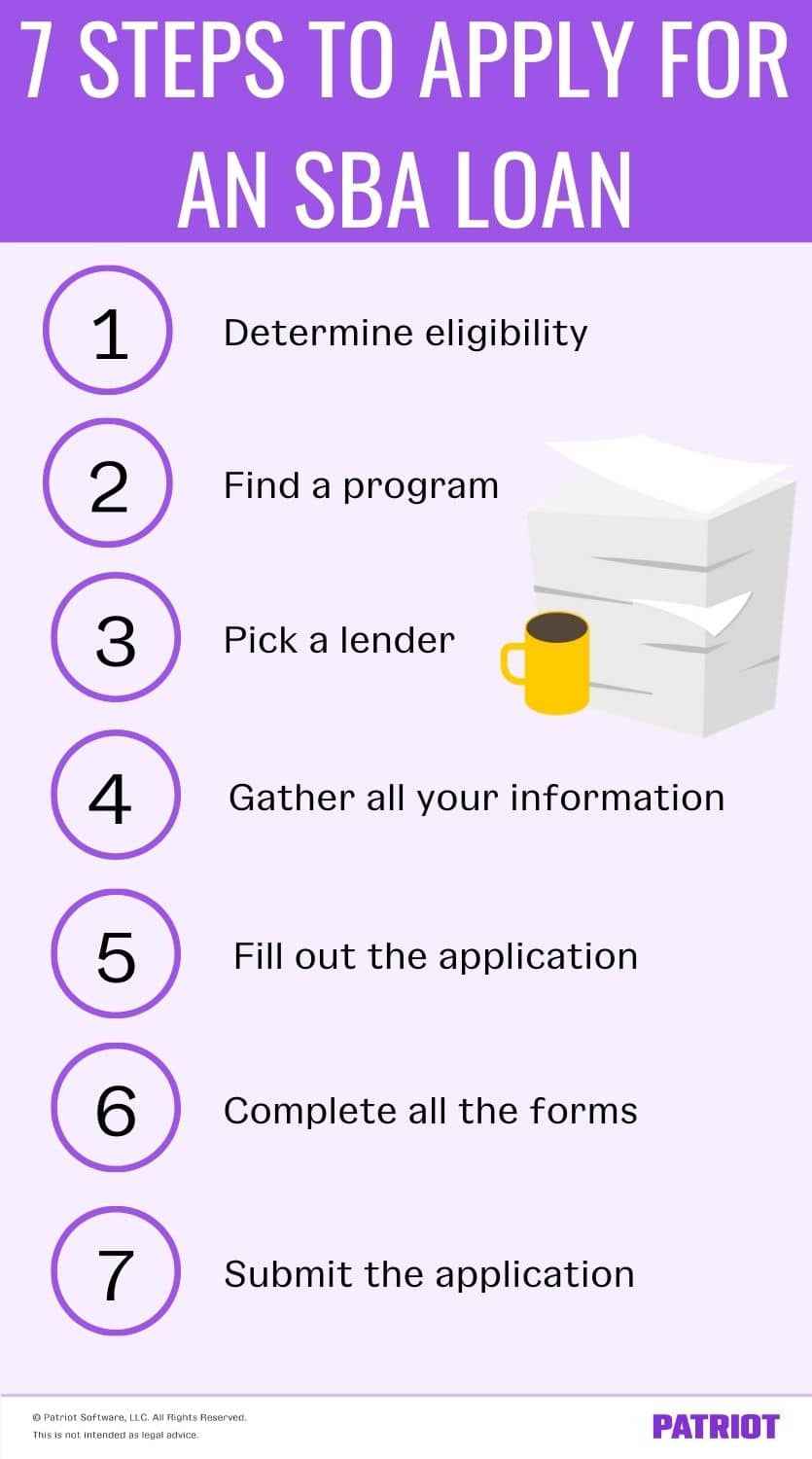

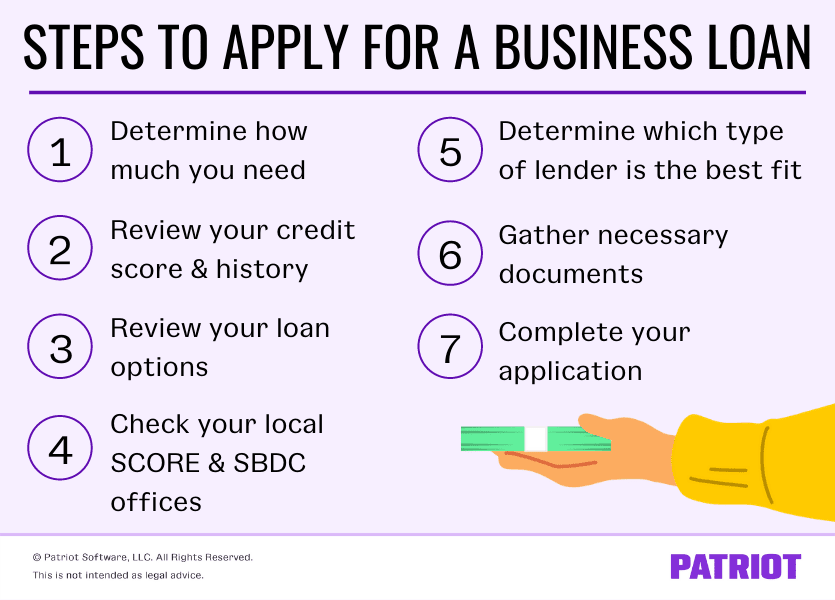

Steps to Apply for an SBA Loan

Step 1: Prepare Your Business Plan

A detailed business plan is essential for your application. It should include:

- Business goals and objectives.

- Market analysis and competitive landscape.

- Financial projections, including income statements and cash flow forecasts.

Step 2: Gather Required Documents

Having your documents ready can expedite the process. Key documents include:

- Personal and business tax returns.

- Financial statements, such as profit and loss reports.

- Legal documents, such as business licenses and registrations.

- A detailed loan purpose statement.

Step 3: Choose the Right SBA Loan Program

Match your funding needs with the appropriate SBA loan type. For example:

- Choose a 7(a) loan for general working capital.

- Opt for a CDC/504 loan for purchasing real estate or equipment.

Step 4: Find an SBA-Approved Lender

Use the SBA’s Lender Match tool to locate approved lenders in your area. Researching and comparing lenders can help you find one that best suits your business needs.

Step 5: Submit Your Application

Complete the application form accurately, ensuring all required fields are filled and supporting documents are attached. Take care to avoid common mistakes, such as incomplete forms or missing information.

Step 6: Wait for Approval

The review process can take several weeks. During this time, the lender and the SBA will evaluate your application, business plan, and creditworthiness.

Tips for a Successful SBA Loan Application

- Maintain a Strong Credit Score: Personal and business credit scores significantly impact approval chances.

- Build a Relationship with Your Lender: Establishing rapport with your lender can lead to better support.

- Be Transparent: Clearly outline how you intend to use the loan and how it will benefit your business.

Alternatives to SBA Loans

If an SBA loan isn’t the right fit, consider other financing options such as:

- Traditional Business Loans: Offered by banks and financial institutions.

- Grants: Ideal for businesses in specific industries or those meeting certain criteria.

- Crowdfunding: An increasingly popular way to raise funds from a large audience.

Each option has its pros and cons, so evaluate them based on your business’s unique needs.

FAQs About SBA Loans

How Long Does It Take to Get Approved for an SBA Loan?

The approval process can take anywhere from 30 to 90 days, depending on the lender and the complexity of your application.

Can Startups Apply for SBA Loans?

Yes, startups can apply, particularly for microloans or specific 7(a) programs tailored to new businesses.

What Happens If I Can’t Repay My SBA Loan?

Defaulting on an SBA loan can result in severe consequences, including damage to your credit and potential collection efforts on any personal guarantees.

Closing Thoughts

Applying for an SBA loan may seem daunting, but it can be a game-changer for your business. With careful preparation and a clear understanding of the process, you can secure the funding needed to grow and succeed. Take the first step today and explore how SBA loans can support your entrepreneurial journey.

Additional Resources

- Related Blog Posts:

- “Top Tips for Writing a Winning Business Plan”

- “How to Improve Your Business Credit Score”

- Free Downloadable Resource: “SBA Loan Checklist for Beginners”

Call to Action

Subscribe to our newsletter for more small business tips and financial insights. Follow us on social media to stay updated on SBA loans and other business financing options.

I’ve added a paragraph with an internal link to the VA business loan page. Let me know if you need further changes or additional content!

Here is a standalone table summarizing the different SBA loan types:

| Loan Type | Purpose | Loan Amount | Repayment Term | Key Benefits |

|---|---|---|---|---|

| 7(a) Loans | General working capital, equipment | Up to $5 million | Up to 10 years (working capital) | Flexible use of funds, high limits |

| CDC/504 Loans | Real estate and large equipment | Up to $5.5 million | Up to 25 years | Low interest, fixed-rate financing |

| Microloans | Startups, small funding needs | Up to $50,000 | Up to 6 years | Ideal for startups, smaller businesses |

Let me know if you want any adjustments to the content!