VA Business Loan: A Comprehensive Guide for Veterans

Starting and growing a business is a rewarding journey, especially for veterans who bring invaluable skills and discipline to the entrepreneurial world. One of the best financial resources available for veterans looking to establish or expand their business is the VA Business Loan. This article explores everything you need to know about VA Business Loans, including their benefits, how to apply, eligibility, and available resources.

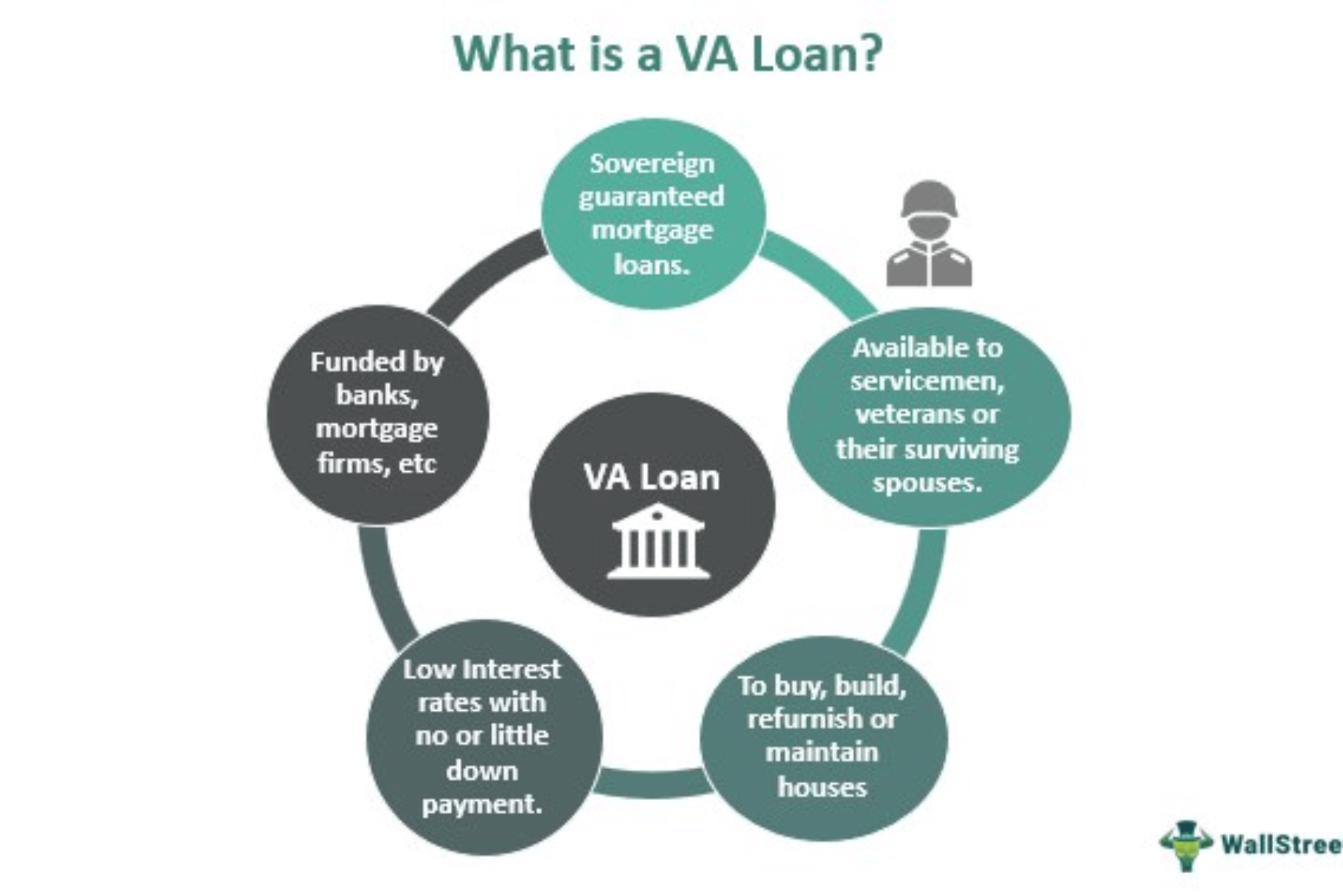

What is a VA Business Loan?

A VA Business Loan is a financial product that is specifically designed for veterans, active military members, and their spouses to help them finance their businesses. These loans are typically backed by the U.S. Department of Veterans Affairs (VA) or the Small Business Administration (SBA), making them a great option for veterans who wish to pursue entrepreneurship.

How It Differs from Traditional Business Loans

Unlike traditional business loans, VA Business Loans offer significant advantages, such as lower interest rates, flexible repayment terms, and a focus on supporting veterans. While many traditional lenders might have higher qualification criteria, VA Business Loans are more accessible to veterans who might face challenges like a lack of collateral or lower credit scores.

Eligibility Criteria for VA Business Loans

To qualify for a VA Business Loan, you must meet certain eligibility requirements. These typically include:

- Military Service: Veterans who have served on active duty, active-duty service members, and eligible spouses.

- Business Ownership: You must own or be in the process of establishing a business.

- Creditworthiness: Though VA loans tend to be more forgiving of credit scores than traditional loans, applicants should still demonstrate the ability to repay the loan.

Benefits of VA Business Loans

VA Business Loans come with a host of advantages that make them an attractive option for veteran entrepreneurs. Here are some of the key benefits:

Financial Support for Veterans

VA Business Loans provide essential financial support to veterans, helping them get their business off the ground or expand existing ventures. These loans cater to veterans’ unique needs and challenges, offering the capital needed to grow in competitive markets.

Low-Interest Rates and Flexible Terms

One of the biggest selling points of VA Business Loans is their low-interest rates. These loans often come with better terms than conventional loans, allowing veterans to pay less in interest over the loan’s life. Additionally, they offer more flexible repayment options, making it easier for veterans to manage their business finances.

Accessible to Various Industries

Whether you are in tech, retail, or service industries, VA Business Loans are available for a broad spectrum of business types. This flexibility allows veterans to pursue their passions across different sectors.

Specialized Support for Veteran Entrepreneurs

Veterans can benefit from resources that help them not only secure funding but also succeed in their business ventures. The VA provides access to counseling, mentorship, and networking, which are critical for growing a small business.

How to Apply for a VA Business Loan

If you’re interested in applying for a VA Business Loan, it’s essential to understand the steps involved in the process. Here’s a step-by-step guide:

Step-by-Step Guide to Application

- Gather Required Documents: Prepare your military service records, a solid business plan, and any necessary financial documents (like tax returns or financial statements).

- Submit Your Application: Reach out to a VA-approved lender or a financial institution that specializes in veteran loans. Many banks and online lenders offer VA-backed loans.

- Complete Eligibility Verification: You will need to provide proof of your military service and other personal information.

Understanding the Application Requirements

You will need the following documents:

- Proof of Service: Your DD214 or other documents verifying your military service.

- Business Plan: A comprehensive business plan outlining how the loan will be used and how you plan to repay it.

- Credit History: Some lenders will review your credit report, though veterans may have more flexibility with credit scores than with traditional loans.

Common Mistakes to Avoid When Applying

- Incomplete Application: Ensure that all documents are submitted properly.

- Ignoring Business Viability: Lenders will assess whether your business plan is feasible.

- Not Exploring All Loan Options: It’s important to explore various types of VA Business Loans to find the best fit for your needs.

Types of VA Business Loans

There are several types of VA Business Loans available to veterans, each catering to different business needs.

SBA-Backed Loans

The Small Business Administration (SBA) offers VA-backed loans that help veterans secure funding with government backing. Two common types of SBA loans for veterans include the 7(a) and 504 loan programs. These loans often have low interest rates and long repayment terms.

Microloans for Veterans

Microloans are small loans that are often available to veterans with limited business experience or small-scale businesses. These loans are ideal for those just starting or looking to scale their business at a manageable level.

Traditional VA Loans for Business

Some veterans may qualify for traditional VA loans through the Department of Veterans Affairs. These loans typically have favorable terms and can be used for a variety of business purposes, from working capital to equipment purchase.

VA Business Loan Resources

Various resources are available to help veterans navigate the loan application process and build successful businesses.

Government Resources

- VA Website: Visit the official VA website for details on available loan programs and eligibility requirements.

- SBA Resources: The Small Business Administration offers loan programs and support specifically for veterans.

Private Lenders Specializing in VA Business Loans

Many private lenders specialize in VA Business Loans. These lenders understand the unique needs of veterans and provide tailored loan options to help you succeed. Banks like Wells Fargo and online lenders such as Fundera offer VA-backed business loans.

Veteran Support Organizations

Veteran-focused organizations like the National Veteran-Owned Business Association (NaVOBA) offer resources to help veteran entrepreneurs access financing, network with other veterans, and receive mentorship and business advice.

Case Studies and Success Stories

Hearing about real-world examples of successful veteran entrepreneurs can provide both inspiration and practical insights. Many veterans have used VA Business Loans to launch successful businesses, from construction companies to tech startups. These entrepreneurs often face unique challenges, such as transitioning from military service to civilian business ownership, but their success stories show that with determination and the right support, it’s possible to thrive.

Frequently Asked Questions (FAQs)

1. What is the interest rate on a VA Business Loan?

Interest rates on VA Business Loans are typically lower than traditional loans, but they vary based on the lender and the type of loan. Generally, veterans can expect interest rates ranging from 4% to 8%, depending on their creditworthiness.

2. Can a spouse apply for a VA Business Loan?

Yes, spouses of veterans and active military members are eligible for VA Business Loans, provided they meet the necessary criteria.

3. How long does it take to get approved for a VA Business Loan?

The approval process can vary, but generally, it may take anywhere from a few days to several weeks, depending on the complexity of your application.

VA Business Loans provide a tremendous opportunity for veterans looking to start or grow their own businesses. With favorable terms, flexible repayment options, and support from government and private institutions, veterans can secure the financial assistance they need to succeed. Whether you’re a seasoned entrepreneur or a first-time business owner, exploring VA Business Loans can be a game-changer in your entrepreneurial journey.

This comprehensive guide offers all the essential information you need to understand and apply for a VA Business Loan. Whether you’re just starting out or looking to expand your business, these loans can be a valuable resource to help achieve your business goals.