Understanding SBA Loans: A Comprehensive Guide for Small Businesses

What is an SBA Loan?

The Small Business Administration (SBA) provides a unique opportunity for small businesses to access funding through SBA Loans. These loans are specifically designed to support small business growth, offer competitive terms, and ensure entrepreneurs have the resources they need to succeed.

In this guide, we’ll explore the types of SBA loans, their benefits, application processes, and more to help you make informed decisions for your business.

Understanding SBA Loans

What Does SBA Stand For?

SBA stands for the Small Business Administration, a government agency dedicated to helping small businesses succeed. The SBA offers support through financial assistance, training programs, and advisory services.

How SBA Loans Work

SBA loans are not directly funded by the SBA. Instead, the SBA acts as a guarantor, reducing the risk for lenders such as banks and financial institutions. This arrangement ensures that businesses with limited credit history or assets can still access funding.

Types of SBA Loans

SBA 7(a) Loan Program

The SBA 7(a) Loan Program is the most popular option, providing versatile funding for working capital, equipment purchases, and real estate investments.

SBA CDC/504 Loan Program

This loan focuses on long-term financing for major business assets like buildings and machinery. It’s ideal for businesses looking to expand their facilities.

SBA Microloan Program

For small-scale funding needs, the SBA Microloan Program offers loans of up to $50,000, making it perfect for startups and small businesses with modest capital requirements.

SBA Disaster Loans

These loans provide critical support to businesses recovering from natural disasters or economic hardships. They cover physical damage and operational losses.

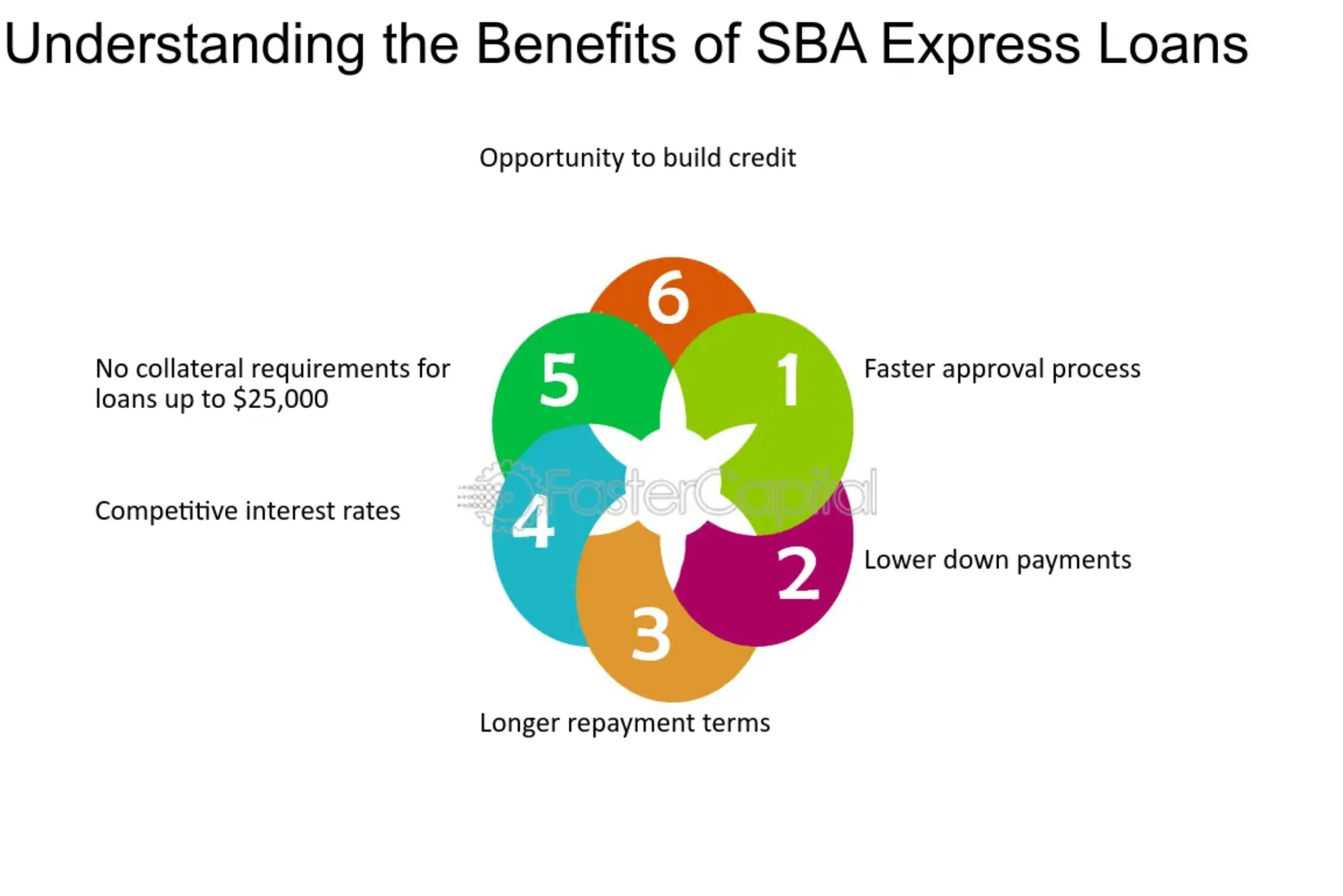

Benefits of SBA Loans

- Low-Interest Rates: SBA loans often feature interest rates below those of conventional loans.

- Long Repayment Terms: Borrowers benefit from extended repayment schedules, easing financial strain.

- Access to Capital: Businesses with limited credit history or smaller operations can still qualify for substantial funding.

Eligibility Criteria for SBA Loans

To qualify for an SBA loan, businesses must meet specific criteria, including:

- Adherence to small business size standards defined by the SBA.

- Operating within the United States or its territories.

- Belonging to eligible industries as outlined by the SBA.

- Demonstrating a good credit history and ability to repay the loan.

How to Apply for an SBA Loan

Preparing Documentation

Start by gathering necessary documents like a detailed business plan, financial statements, and credit reports. These documents demonstrate your business’s viability and repayment capacity.

Choosing the Right SBA Loan Program

Evaluate your business needs and select the loan program that aligns with your objectives, whether it’s for working capital, equipment, or disaster recovery.

Finding an SBA-Approved Lender

Utilize the SBA Lender Match Tool to connect with approved lenders. Establishing a good relationship with your lender can improve your application success rate.

Submitting Your Application

Complete the required forms and ensure all documentation is accurate and comprehensive. Respond promptly to lender inquiries to avoid delays.

Challenges and Tips

Common Challenges in Getting an SBA Loan

- The approval process can be time-consuming, often requiring weeks or months.

- Extensive documentation is needed, which can be overwhelming for small business owners.

Tips for a Successful SBA Loan Application

- Clarify Your Business Plan: A detailed and realistic plan strengthens your case.

- Improve Your Credit Score: A strong credit profile increases approval chances.

- Build Relationships with Lenders: Familiarity with lenders can streamline the process.

SBA Loan FAQs

What is the Maximum Amount You Can Borrow Through an SBA Loan?

The maximum amount varies depending on the loan type. For instance, the SBA 7(a) program allows loans of up to $5 million.

How Long Does it Take to Get an SBA Loan Approved?

Approval timelines range from a few weeks to several months, depending on the loan program and the completeness of your application.

Can a Startup Qualify for an SBA Loan?

Yes, startups can qualify for certain SBA loan programs, such as the Microloan Program, provided they meet eligibility requirements.

Success Stories: Businesses that Thrived with SBA Loans

SBA loans have empowered countless businesses to expand, innovate, and thrive. For example, a local café used an SBA loan to upgrade its facilities, leading to increased customer satisfaction and revenue growth. Another small manufacturer invested in modern machinery, boosting productivity and profits.

SBA loans offer invaluable support to small businesses by providing accessible funding, favorable terms, and growth opportunities. If you’re ready to take your business to the next level, explore SBA loan options and connect with approved lenders to kickstart your journey.

Would you like assistance with your SBA loan application? Let us know in the comments or contact an SBA advisor today!