Low Interest Business Loan: Your Ultimate Guide to Affordable Financing

Starting and running a business requires capital, and finding a financing solution that doesn’t strain your budget is crucial. Low-interest business loans offer an excellent opportunity for entrepreneurs to access funds while keeping repayment costs manageable. In this guide, we’ll explore everything you need to know about low-interest business loans.

What Are Low Interest Business Loans?

Understanding the Basics

A low-interest business loan is a financing option where lenders provide funds at a reduced interest rate compared to standard loans. These loans are designed to help businesses grow while ensuring repayments are affordable.

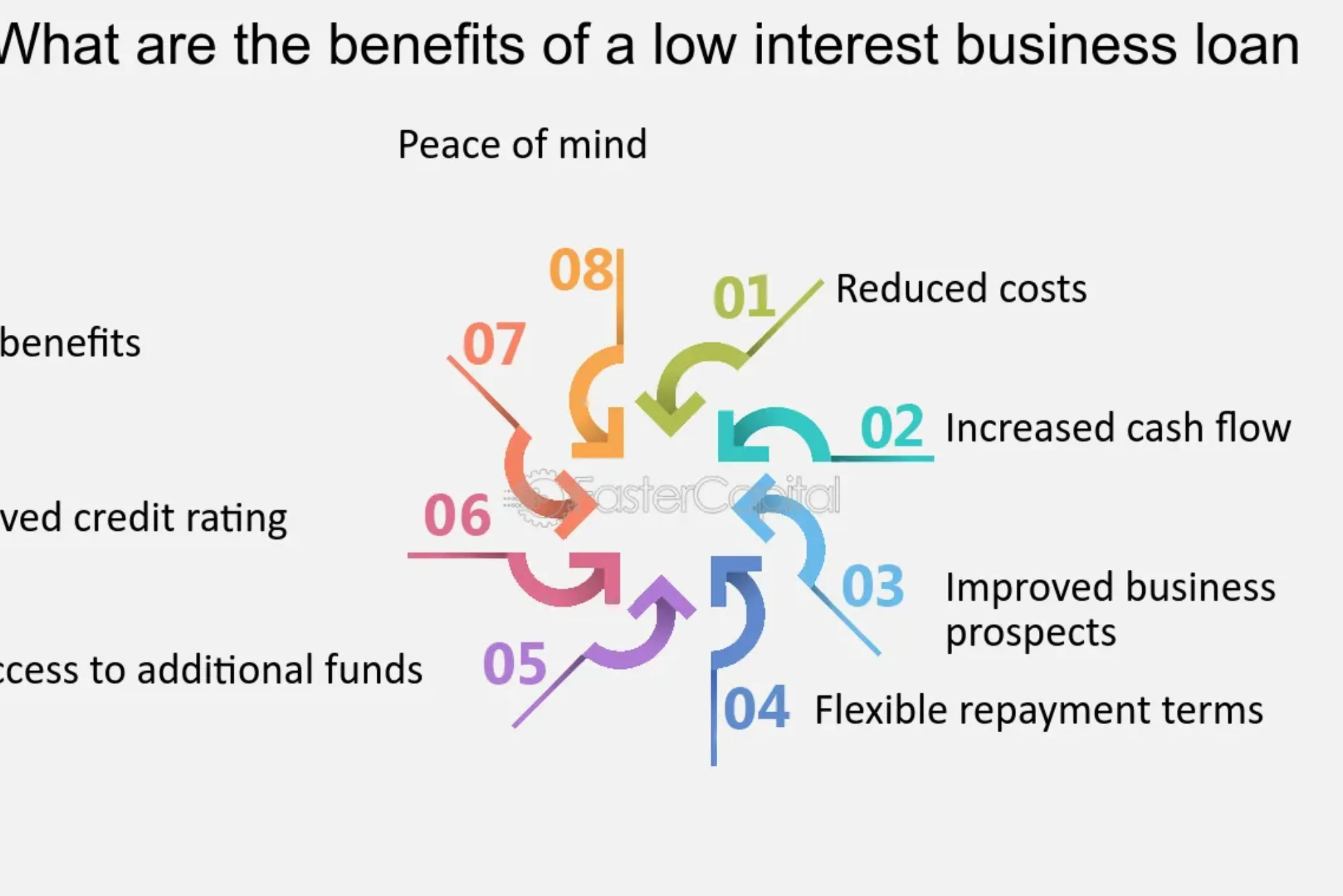

Key Benefits

- Cost-Effectiveness: Save money on interest payments.

- Improved Cash Flow: Lower monthly payments allow businesses to allocate resources elsewhere.

- Easier Expansion: Affordable financing supports business growth initiatives like hiring, marketing, or inventory.

Top Providers Offering Low Interest Business Loans

Bank vs. Online Lenders

- Banks: Offer competitive interest rates but often have stricter eligibility criteria.

- Online Lenders: Provide convenience and faster approvals, though rates may vary.

Recommended Providers

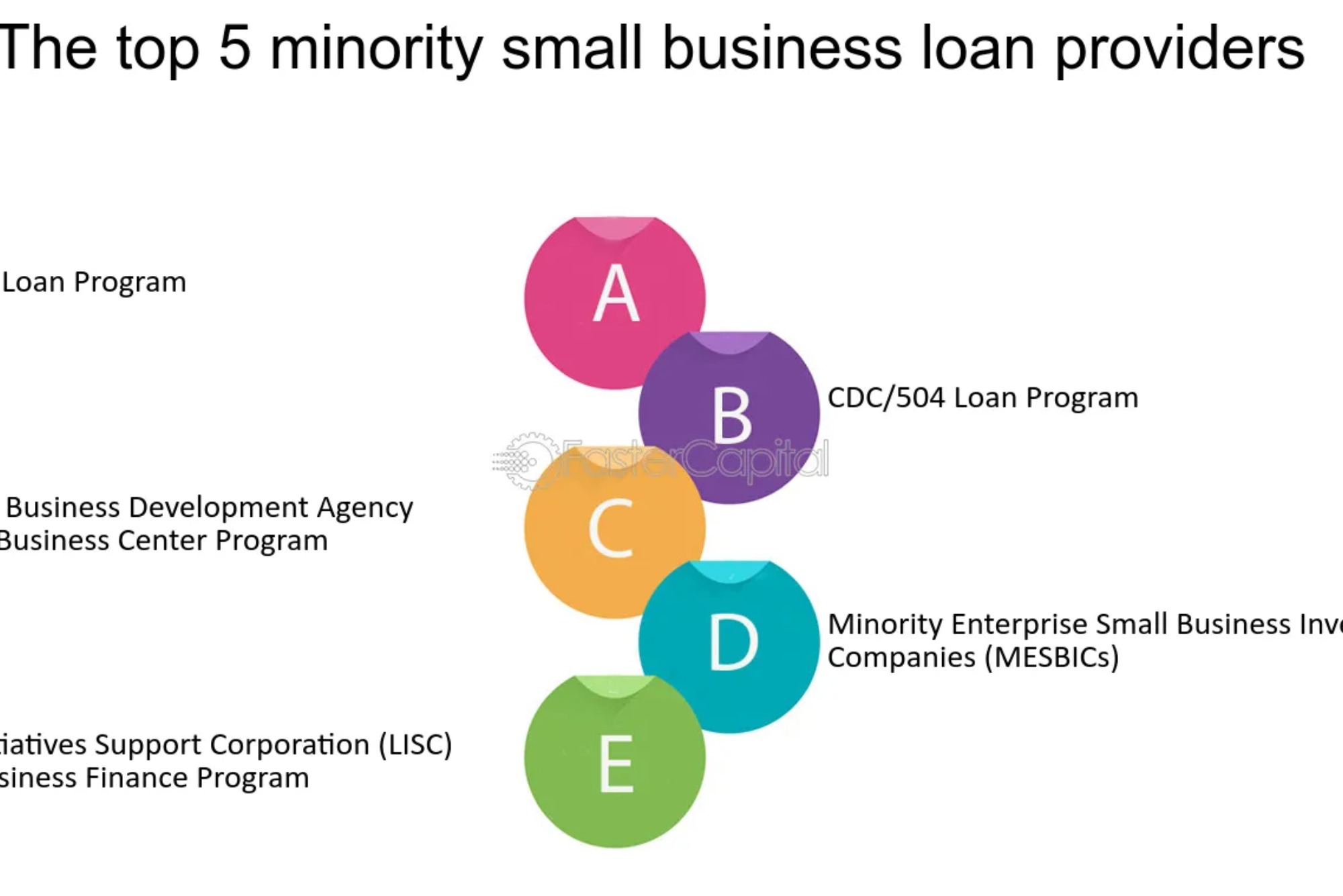

- Small Business Administration (SBA): Known for their 7(a) loan program with low interest rates.

- Kabbage: Offers flexible repayment terms tailored to small businesses.

- LendingClub: Provides competitive rates for businesses with strong credit.

How to Qualify for a Low Interest Business Loan

Improve Your Credit Score

Lenders prioritize businesses with solid credit histories. Focus on:

- Paying bills on time.

- Reducing existing debt.

- Monitoring your credit report for errors.

Prepare a Strong Business Plan

A comprehensive business plan reassures lenders of your ability to repay. Include:

- Financial projections.

- Revenue streams.

- Details about your market and competition.

Research Lenders

Different lenders have varying requirements. Compare options to find the one that aligns with your needs.

Tips for Managing Your Loan

Use Funds Wisely

- Invest in activities that drive growth, such as marketing, inventory, or equipment.

- Avoid using loan funds for non-essential expenses.

Monitor Cash Flow

Monitor Cash Flow

Ensure your business maintains enough revenue to cover loan repayments without impacting operations.

Common Questions About Low Interest Business Loans

What Is a Good Interest Rate for a Business Loan?

A good interest rate for a business loan typically ranges between 3% and 8%. Rates may vary depending on creditworthiness, loan type, and lender policies.

How Can I Secure the Lowest Interest Rate?

- Maintain a high credit score.

- Offer collateral if possible.

- Choose shorter repayment terms.

Real-Life Success Stories

Case Study: A Retail Startup

Jane Doe, the owner of a boutique store, secured a low-interest SBA loan to expand her inventory. By saving on interest payments, she reinvested in marketing, resulting in a 40% revenue increase within a year.

Case Study: A Tech Entrepreneur

John Smith used a low-interest online business loan to fund his startup’s product development. The affordable repayments allowed him to maintain cash flow and hire key talent, leading to a successful product launch.

Tools to Help You Get Started

Loan Calculator

Estimate your monthly payments and total interest using our Loan Calculator tool.

Checklist for Loan Application

- Credit report.

- Tax returns.

- Financial statements.

- Business plan.

Low-interest business loans can be a game-changer for entrepreneurs looking to grow their businesses without excessive financial strain. By understanding how these loans work, qualifying criteria, and choosing the right provider, you can unlock the funding you need to achieve your business goals.

Take the first step today—explore your options and secure the financing that works best for you!