No Doc Business Loans: A Comprehensive Guide

What Are No Doc Business Loans?

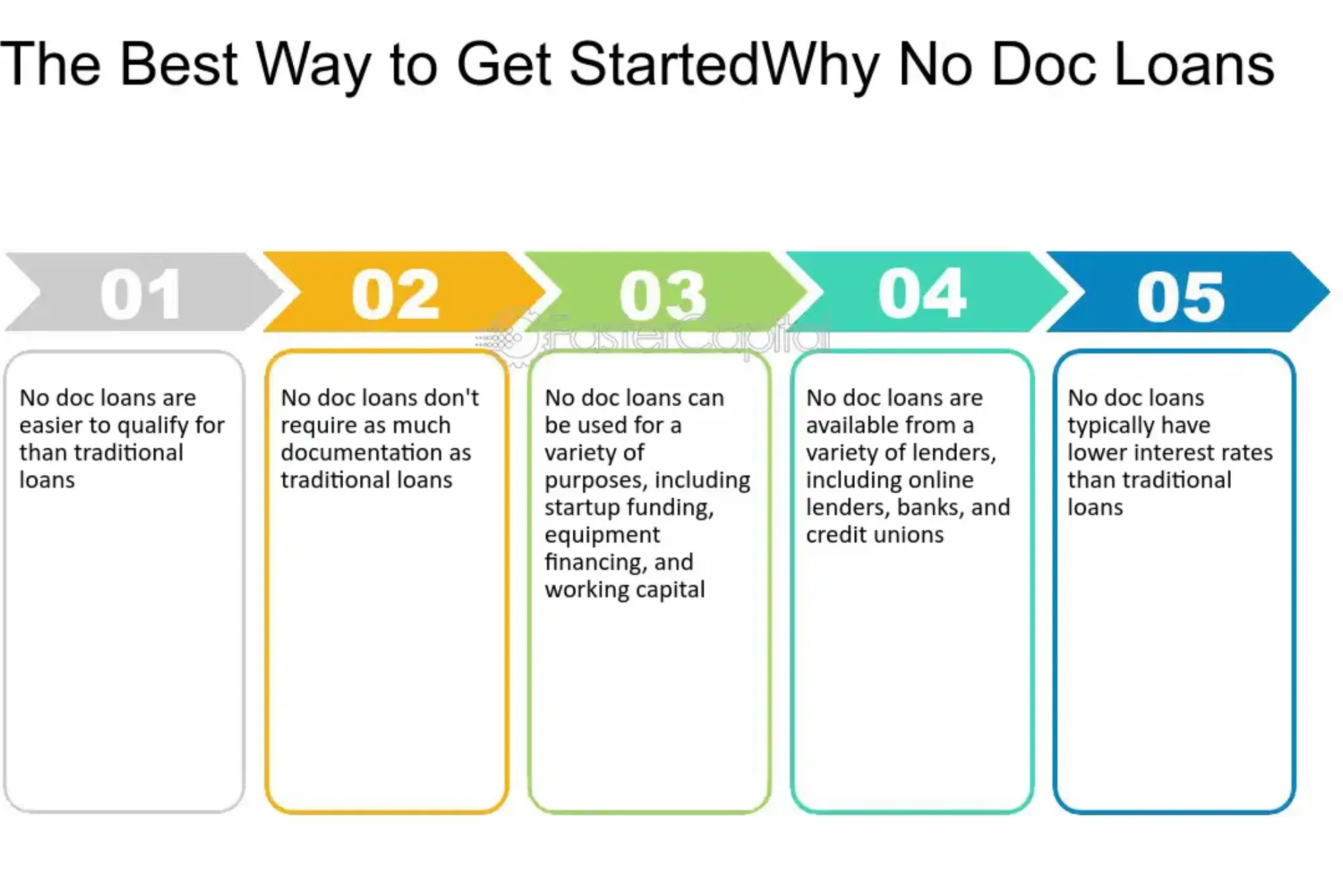

No Doc Business Loans are financing options designed for business owners who want to bypass the traditional paperwork-heavy process. Unlike conventional loans, which often require extensive documentation like tax returns, business plans, and financial statements, No Doc loans offer a simpler and faster way to access funds. These loans cater to individuals seeking quick funding without the burden of excessive formalities, making them an attractive choice for small business owners, freelancers, and startups.

Advantages of No Doc Business Loans

Quick Approval Process

One of the most appealing features of No Doc Business Loans is the swift approval timeline. Since lenders don’t require extensive documentation, applications can be processed and approved in a matter of days—or even hours in some cases.

Simplified Application

The application process for No Doc loans is straightforward. Business owners typically need to provide basic details, such as their business name, revenue, and a valid identification, making it easier for those who may not have their financial records organized.

Accessibility

These loans are often more accessible for individuals with lower credit scores or newer businesses without a long operational history. They provide a much-needed financial lifeline to those who might otherwise struggle to secure traditional loans.

Disadvantages of No Doc Business Loans

Higher Interest Rates

No Doc Business Loans usually come with higher interest rates compared to conventional loans. This compensates for the lender’s increased risk due to the lack of documentation.

Shorter Repayment Terms

These loans typically have shorter repayment periods, which may place a financial strain on businesses if cash flow is inconsistent.

Risk of Over-Borrowing

The ease of access can tempt some business owners to borrow more than they can realistically repay, leading to potential financial difficulties.

Who Qualifies for No Doc Business Loans?

No Doc Business Loans are ideal for startups, freelancers, and small business owners who need immediate funding without the hassle of extensive documentation. Lenders may still require proof of revenue, a basic credit score check, or verification of business existence, but the requirements are minimal compared to traditional loans.

Types of No Doc Business Loans

Merchant Cash Advances

This type of loan provides an upfront lump sum in exchange for a percentage of future sales. It’s particularly suitable for businesses with steady credit card transactions.

Invoice Financing

Businesses can leverage unpaid invoices to access quick cash, helping them maintain operations while awaiting customer payments.

Business Lines of Credit

A flexible option that allows businesses to draw funds as needed, paying interest only on the amount used.

Online Microloans

Small, short-term loans offered by online lenders, often with minimal documentation and quick approval times.

How to Apply for a No Doc Business Loan

Preparation Steps

Before applying, gather basic information about your business, such as revenue details, business registration, and identification documents.

Recommended Lenders

Research platforms and lenders known for offering No Doc loans, such as online fintech companies and alternative lenders. Read reviews and compare interest rates to find the best fit.

Tips for Approval

To increase the likelihood of approval, ensure your business has consistent revenue streams and a decent credit score. Clear any outstanding debts and present a professional application.

When to Consider No Doc Business Loans

These loans are most beneficial for businesses that need immediate funding for emergencies or growth opportunities. However, it’s crucial to evaluate the terms carefully and avoid predatory lenders.

Alternatives to No Doc Business Loans

Loans with Minimal Documentation

These loans require slightly more paperwork but often come with lower interest rates and better terms.

Personal Loans for Business Use

If you have good personal credit, this can be an alternative source of funding.

Crowdfunding or Investor Options

Platforms like Kickstarter or seeking venture capital can provide funding without the need for loans.

Conclusion

No Doc Business Loans offer a convenient and fast financing option for businesses needing quick access to cash. While they come with their own set of advantages, such as simplified applications and quick approvals, they also carry drawbacks like higher interest rates and shorter repayment terms. Before applying, weigh the pros and cons carefully, and explore alternative funding options if necessary. Always consult a financial advisor to ensure the loan aligns with your business needs and financial health.

FAQs

What is the maximum amount I can borrow through No Doc Business Loans?

The maximum loan amount varies by lender but is often lower than traditional loans, typically ranging from $5,000 to $250,000.

Are there any hidden fees involved?

Some lenders may charge origination or administrative fees. Always read the loan agreement carefully to avoid surprises.

Can startups apply for No Doc Business Loans?

Yes, startups can apply, but they may need to demonstrate proof of revenue or provide a personal guarantee to secure the loan.